Table of Contents

Accidents happen every day in Toronto, from minor fender-benders on city streets to serious automobile collisions that make the car accident on the news. After a crash, the injured driver or passenger must navigate Ontario’s insurance system. In Ontario’s no-fault insurance system, accident victims first claim benefits from their own insurance company regardless of who caused the crash.

For example, when a Toronto driver suffered a serious back injury in a collision, she learned that her accident benefit claim could cover medical care and lost wages even though she was partly at fault. This article explains how Ontario’s accident benefits and compensation system works, what injuries qualify for what payouts, and how typical claim outcomes are determined.

When a Toronto resident reads about a crash in the news, it often raises questions about coverage. In Ontario, every driver must carry insurance that includes Statutory Accident Benefits. Under the Statutory Accident Benefits Schedule (SABS), anyone injured in a car crash is entitled to accident benefits – no matter who was to blame. Those benefits can pay for things like rehabilitation, attendant care, and even a portion of lost income (up to 70% of gross income, capped at $400/week). For instance, after her collision, the Toronto driver could claim income replacement, physiotherapy, and home care support under SABS – all from her own insurer.

- Accident Benefits (no-fault): Ontario’s no-fault insurance means each injured driver deals with their own insurance company first. Statutory Accident Benefits include medical and rehab costs, attendant care, income replacement, caregiver and housekeeping benefits, and more.

- Who qualifies: Drivers, passengers, pedestrians, or cyclists hurt in a crash can apply for SABS. Even if someone did not own a car (for example, a passenger or cyclist), they can claim through the at-fault driver’s insurer or through a government fund.

- Key SABS coverages (amounts under a standard policy):

- Income Replacement: Up to 70% of pre-accident gross income (max $400/week) if you can’t work.

- Attendant Care: Up to $3,000 per month (non-catastrophic injuries) or $6,000/month (catastrophic) to pay for home help or care workers.

- Medical/Rehabilitation: All necessary treatment (physio, chiropractic, etc.), prescriptions, assistive devices and more are covered.

- Non-Earner Benefits: Up to $185/week (rising to $320 after two years) if you can’t perform daily activities after the crash.

If the insurance company disputes a claim or denies benefits, Ontario law provides a process. The injured person can request a review of the decision or ultimately file a dispute with the Licence Appeal Tribunal (LAT) to force payment.

For students learning how to research Ontario law and administrative procedures, our step-by-step legal research guide explains how to read statutes, regulations, and tribunal decisions effectively.

In practice, many denied claims can be overturned on appeal. A helpful way to remember the accident benefit claim process is: notify your insurer of the crash, submit the SABS application forms (OCF-1 etc.), and if needed challenge any denials through the LAT or with a lawyer’s help.

Motor Vehicle Accident Settlement & Compensations for Injuries

Ontario separates statutory benefits (no-fault) from tort compensation (sue-at-fault). Minor injuries generally receive only the no-fault benefits described above, but more serious injuries allow victims to sue for additional damages. The system uses a “threshold” for pain and suffering: only injuries that are considered serious, permanent, and important (or disfiguring) qualify for a tort claim. In other words, only after meeting the legal threshold can you pursue a motor vehicle accident settlement in court for things like pain and suffering, loss of capacity, or more.

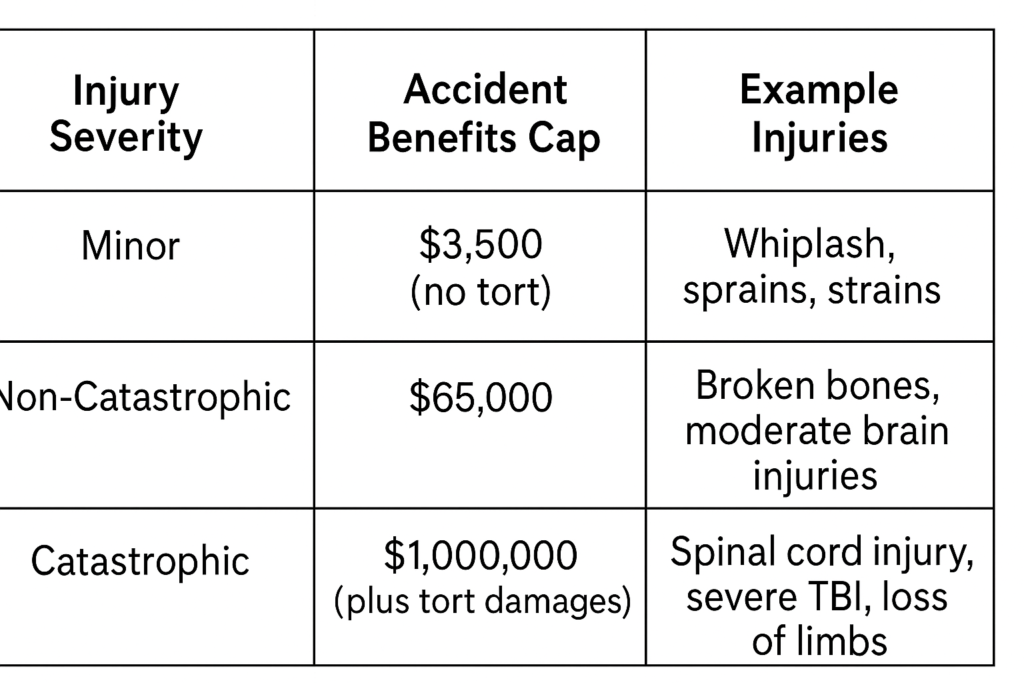

Typical settlement amounts vary widely. For example, one Ontario law firm notes the caps on accident benefits by injury severity. In minor accident cases (whiplash, strains), the no-fault payout maxes out at $3,500, and pain-and-suffering compensation is usually not available unless the injury exceeds the legal threshold. For non-catastrophic injuries (broken bones, long-term pain, mild brain injury), accident benefits can reach up to $65,000. For the worst injuries (like spinal cord damage, severe brain injury or amputations), the cap is $1,000,000 plus potential tort damages.

The table below summarizes these categories:

Table: Ontario accident benefit caps by injury category.

Beyond no-fault caps, a serious case can bring additional auto injury settlement money through a successful lawsuit. Nationally, the average personal injury payout for a motor vehicle crash is around $120,000 (this covers only the “pain and suffering” portion, not out-of-pocket costs). Catastrophic injury cases (like paralysis or major limb loss) routinely exceed this average.

In practice, actual settlements vary a lot. The patient’s age, income, and recovery prospects all matter. For example, a Toronto hospital worker with a herniated disc might get a larger award for future care costs than a college student with a sprained ankle. It’s important to note that the final amount depends heavily on legal strategy. For instance, a well-prepared case and a skilled motor vehicle accident lawyer can maximize compensation, whereas a weaker claim might settle for less. (After all, a car accident settlement isn’t fixed each case is unique. The settlement amount often depends on factors like legal counsel quality.)

Insurance Costs and Special Coverage

Car insurance is expensive in Ontario. The average car insurance cost in Ontario is about $1,927 per year, making it one of the highest in Canada. Premiums vary by driver: younger and older drivers pay more. For example, Ontario drivers aged 16–19 average about $3,550/year, while drivers 60+ average around $1,565. (The chart below illustrates how premiums drop with age.)

Figure: Average annual car insurance premiums in Ontario by age group. Young drivers pay far more; insurers charge highest rates (in 2025) for ages 16–19.

Insurance costs also vary by city. Urban areas like Toronto have higher rates (around $2,400/year) than rural areas. These costs have been rising in recent years as claim rates and repair costs climb.

Another factor: non-owner car insurance Ontario:

If you frequently drive borrowed or rented cars but don’t own a vehicle, Ontario lets you add a non-owner coverage endorsement (Form OPCF-27) to an existing policy. This provides liability coverage for accidents in a vehicle you don’t own. You cannot buy a separate non-owner policy; it must be tacked onto your own insurance. On average, this non-owner add-on costs about $200–$500 per year in Ontario. It covers damage to others and injury liability but does not pay for damage to the car you’re driving.

Because premiums are high, drivers often shop for discounts or changes. But one must be careful: “gateway” coverage or no-fault reforms are coming in 2026, meaning more coverage will be optional. In short, if you skip optional coverages (like enhanced income replacement or catastrophic benefits) to save on premiums now, you might lose those protections after 2026. Always review your auto policy carefully to make sure you have the insurance you need.

Filing a Claim and Outcomes

After an accident in Toronto, the injured party should immediately notify their insurer and begin an accident benefits claim. There are strict timelines generally you must report within days and file medical and income forms quickly. If everything is in order, the insurer will pay the statutory benefits up to the limits described above.

If the insurer denies or cuts off benefits, the insured can dispute the decision. Ontario provides that you can request reconsideration of the insurer’s decision or take the dispute to the Licence Appeal Tribunal (LAT). In practice, many claims are reversed on appeal. (In fact, insurers routinely deny benefits initially, expecting some claims to drop out.) The claimant is advised to keep detailed records of treatment and follow-up with any requests for documentation to avoid denials.

If the injury meets the legal threshold, the claimant may also sue the at-fault driver. In that case, Ontario law requires damages first cover those SABS payments, then adds extra for pain and suffering or other losses. Even if the driver was at fault, the injured person’s own insurer still paid the accident benefits; any additional settlement comes from the at-fault party’s insurer.

In summary, a typical Toronto accident claim might involve: (1) filing an accident benefits claim with your own insurer (no-fault) and receiving medical/income benefits; (2) if injured seriously, negotiating or litigating a tort claim against the at-fault driver to cover pain, loss of capacity, etc; (3) appealing to LAT if the benefits claim is denied. Throughout, it’s important to note that every case is different. Two people with the same crash can see very different outcomes, depending on injury severity, pre-existing health, income level, and the legal approach.

Frequently Asked Questions

What is an insurance claim?

An insurance claim is a formal request by a policyholder for payment from their insurance company after a covered loss. For example, after a car crash in Toronto, the accident victim files a claim with their auto insurer to request payment for injuries, medical bills, or car repairs under their policy. The insurer then reviews the claim and pays out covered expenses according to the policy terms.

What are accident benefits in Ontario?

Under the Statutory Accident Benefits Schedule (SABS), if you’re injured in an automobile collision, Ontario law mandates certain benefits. These include coverage for medical care, rehabilitation, attendant care, income replacement, and more. They are payable by your own insurer regardless of who caused the crash.

How does no-fault insurance work in Ontario?

Ontario’s no-fault system means every driver’s insurer pays the basic accident benefits for their policyholder no matter who was at fault. Fault only matters for deductible or premium adjustments. If injuries are minor, the no-fault benefits may fully resolve the case. If injuries are serious (above the legal threshold), the injured person may also sue the at-fault driver for additional compensation.

How much is the average car insurance cost in Ontario?

The average car insurance cost in Ontario is about $1,927 per year. This can vary from roughly $1,500 to $2,500 for most drivers, depending on age, driving history, and location. Young drivers face the highest rates (e.g. ~$3,550/year for ages 16–19). Urban cities like Toronto and Brampton tend to have higher average premiums than rural areas.

What is non-owner car insurance?

Non-owner car insurance in Ontario is an add-on coverage (OPCF-27) you attach to an existing auto policy if you often drive cars you don’t own. It provides liability coverage when you rent or borrow a vehicle. You cannot buy it by itself; it costs roughly $200–$500 per year. It does not cover damage to the vehicle you’re driving or your own injuries, but it covers liability for damage or injury to others.

How are accident settlements determined?

Settlements depend on injury severity, fault, and other factors. Minor injuries typically only get no-fault benefits (up to about $3,500). More serious injuries can trigger higher benefits (up to $65,000 non-catastrophic, $1,000,000 catastrophic). Only injuries meeting the “serious and permanent” threshold allow additional pain-and-suffering awards. Key factors include medical costs, lost income, future care needs, and of course how skilled a lawyer negotiates the case. (Ultimately, each motor vehicle accident settlement is unique the amounts above are guides, not guarantees.)

What should I do after a crash?

First, ensure everyone is safe and call 911 if needed. Then exchange insurance information and notify your insurer of the accident. Seek medical attention even if injuries seem mild. If you decide to make a claim, file the appropriate accident benefits forms (OCF-1, OCF-3, etc.) and keep records. If your claim is denied or cut off, you have the right to appeal that decision. Talking to an experienced personal injury or accident benefits lawyer can help protect your rights and maximize the outcome.

What is a insurance claim?

(sic) An insurance claim is the process of requesting payment from an insurance company for a loss covered by an insurance policy. In the context of a car accident, after a crash you file a claim with your auto insurer asking them to cover your losses (like car repairs or medical bills) according to your policy terms.

Where can I get legal help?

If you’re unsure about your claim or think you deserve more, consult a personal injury lawyer. A skilled motor vehicle accident lawyer can clarify your entitlements, handle appeals, and negotiate fair compensation. Remember: every case is different, and the outcome often depends on building the strongest possible claim.

Comments

I will immediately snatch your rss as I can not find your e-mail subscription link or e-newsletter service. Do you’ve any? Please permit me recognize so that I may subscribe. Thanks.